5 Best Budgeting Apps For 2019

The new year usually comes with making new resolutions such as losing weight, making money, saving money etc. I haven’t made any new year resolutions and I’ll explain why in my next post. However around August last year, I sat myself down for a little “me pep talk” and I repeatedly told myself “Girl you will end your 20’s broke if you continue like this”. Continue what? you may ask, but there’s no need for plenty explanations because at one point or another we all have experienced a period where you couldn’t account for how you spent all the money you had. That was the point I was at. So after that pep talk, I went on a reading marathon, visited some of my favourite 20 somethings career/finance blogs like careergirldaily and girlboss. I gathered all I could about budgeting and saving and then my journey began.

Within the last six months, I have shocked myself by myself. I would never had believed that I could actually save so much. It might not be so much based on your financial strength but for me, it’s a lot! Of course I can’t disclose how much, but if things go smoothly and I double my streams of income in 2019 and put aside some more money, probably by the end of 2019, you can officially add millionaire to my title. No Kidding!

Now we have established that I was once like you- a 20 something or less/more year old girl with an account balance of Zero naira, Zero Kobo, let me give you the five best budgeting apps that will change the way you handle money.

Best Budgeting Apps for 2019

Bucket

A few years ago when I first began the “let me save” journey, one of the apps I tried out was an app called bucket and I loved it. Sadly, saving didn’t go well for me then because I was using a military-like kind of approach where I was trying to save far above my limits, at the end of the day, I snapped and squandered all I had saved. However, when I set out to give saving another chance, I downloaded the Bucket apps again and this app is amazing. It is easily one of my favourite best budgeting apps for 2019.

Bucket is a budgeting app that helps you manage your saving goals clearly. It comes packed with a lot of features.

- Bucket is one of the most user experience friendly budgeting apps you will find. The layout is easy and concise.

- Bucket comes with different categories for saving. You create your saving goals e.g Vacation saving goals, School saving goals etc.

- Bucket constantly reminds you of your saving goals and helps you track how far you have gone. They show you the saving percentage of each goal you have attained.

- Bucket doesn’t compulsorily calculate only money saved in your bank account, you can use other saving means like piggy bank etc yet Bucket will still keep track of your saving goals.

It is a truly incredible budgeting app and I highly recommend it.

Monefy

Monefy is an expense tracker app and a very efficient one at that. I have been using monefy to track my expenses for the past months and I am beyond impressed.

Some of the features that makes monefy one of the best budgeting apps there is.

- It is user friendly, very easy to use. I am big on apps that consider UX as a major factor and Monefy does just that.

- It’s interface is so cute. Unlike some other expenses tracker app, monefy makes use of icons representing different categories of expenses such as plate icon representing feeding expenses, motor icon representing transport expenses and so on. Which makes it easier to use.

- Monefy Allows you to add expenses based on dates and even if the date is passed, you can still edit your expenses.

- Allows synchronization to your Google drive or Dropbox. So perchance something happens to your phone, you’ve got no worries.

- Monefy is passcode protected to keep prying eyes away from your expenses.

- It is free of ads

Monefy has a Pro version which I believe has more features. It is available on Play store for N500, less than $2 but I use the free version and it works perfectly well for me. One trick to help you stay true to tracking your expenses is to add to the app as you spend or if you have a very retentive memory, you can make adding expenses as part of your night time routine. This is definitely a must have best budgeting app for 2019.

YNAB

You need a budget which is popularly known as YNAB is a cult favourite budgeting app. I downloaded this app merely out of curiosity- to find what the buzz was about and I don’t regret it.

YNAB is a personal finance and tracker app. It sorts of incorporates the functions of monefy and bucket together. This app is free for 34 days, before you will be required to pay $6.99 to use.

- YNAB’s mantra is “give every dollar a job” and so this budgeting app works in a rather unique way. It synchronizes with your bank accounts and whenever your paycheck comes in, you can break it down by giving every dollar a job based on what you want to spend money on. For eg, clothing, food, birthday gifts etc.

- Ynab also encourages you to put away some money for the raining days – miscellaneous.

- Real time budgeting: YNAB allows you to budget with your partner or friend. So you both can ace your saving goals together.

I use Ynab to make my every Naira accountable. When my paychecks come in, I split money into different expenses categories like transportation, lunch, vex money etc. I find doing this helps me stay committed to slaying my saving goals. As I have a clear idea of how much I am allowed to spend on each category monthly and so I try to stay within the confines of my budget.

Wallet

Wallet is like the ultimate personal finance app. It actively plans and manages your money. Wallet is a versatile app that allows different currencies and financial institutions worldwide and this is my favourite feature about the app. As most apps only allow banks in the United States and Canada. It syncs your bank accounts, compare with your budgets and gives you reports on your financial situation.

Piggybank.ng

If you can’t tell, I saved the best for the last. Piggybank.ng is an online savings and investment app. When I first heard about piggybank I was skeptical about it. I asked myself questions like what if my money disappears, who do I hold accountable and so on. Well after reading all about piggybank.ng on their website and confirming they have a physical office, I took the plunge and began to save on piggbank.ng. And so far this has been the best decision I have made for my financial life. Piggybank.ng is beyond amazing.

- It has an easy to use and attractive interface.

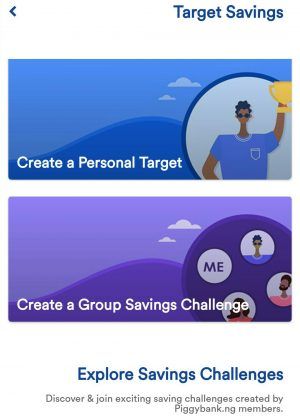

- Saving can be done in different ways as piggy bank has different saving plans like core savings, target savings etc.

- You accrue monthly interests on your savings

- You can set multiple saving goals like saving for rent, saving for new phone etc and set a finishing date for each. This plan totally comes in handy for perodic payments such as house rents.

- Saving can be either manual or automated.

- Saving can be done either daily, weekly or monthly.

- Your account details are secured.

Piggybank also has a plan called safe lock where as the name implies, you can safe lock your funds until a certain time. You can find more details about piggy bank here. Please carefully read through their withdrawal policy before you start saving as they charge a certain percentage when you withdraw on a date that isn’t one of your four withdrawal dates.

To join piggy bank and start saving, you can click on this link to get started.

PS. I get a little commission when you sign up using the above link and you also get free N500 when you sign up using the above link. So you see it’s really a win win situation.

How are you securing your future financially? Have you tried using budgeting apps? Did you find this post on the best budgeting apps for 2019 helpful? if yes please leave a comment and share this post with friends.

LET’S GET SOCIAL

INSTAGRAM: @GIFTCOLLINSBLOG

YOUTUBE: @GYIFTED

TWITTER: @GYIFTED

FACEBOOK: @GIFT COLLINS

Well informative and concise post. I’ve only used Piggybank so far and it has worked well for me. At some point last year, I stopped using it but I’m back to it again after seeing your WhatsApp status.

For tracking my expense, I just use Numbers. It’s an like an excel like sheet on IOS. Monefy sounds like what I’d like however.

Why am I just reading this…I’ve heard about piggy bank.

Thank u for such an insightful post!

https://nyphewrites.wordpress.com/product-review-miracle-leave-in-conditioner/