My experience using Cowrywise to save and invest has been quite interesting.

One of my long term goals is to have financial freedom by the time I am 40. I know it’s a long shot given the economic state of my country (Nigeria) but I have always been a high achiever and when I set my mind on something, I give my 100% towards achieving it. So, when I first heard about Cowrywise, I said to myself this is probably a good means to work towards my financial freedom goals but that wasn’t until I had cleared my every doubt that it wasn’t a scam scheme.

I first heard about Cowrywise from my blogger friend Niella of Niella’s Creation. She shared this with me during a casual conversation where we talked about saving and she told me she was saving judiciously with Cowrywise. You bet my curiosity was piqued and I decided to try out Cowrywise.

What is Cowrywise About?

Cowrywise is a Fintech company that provide accessible savings and investments plans for all.

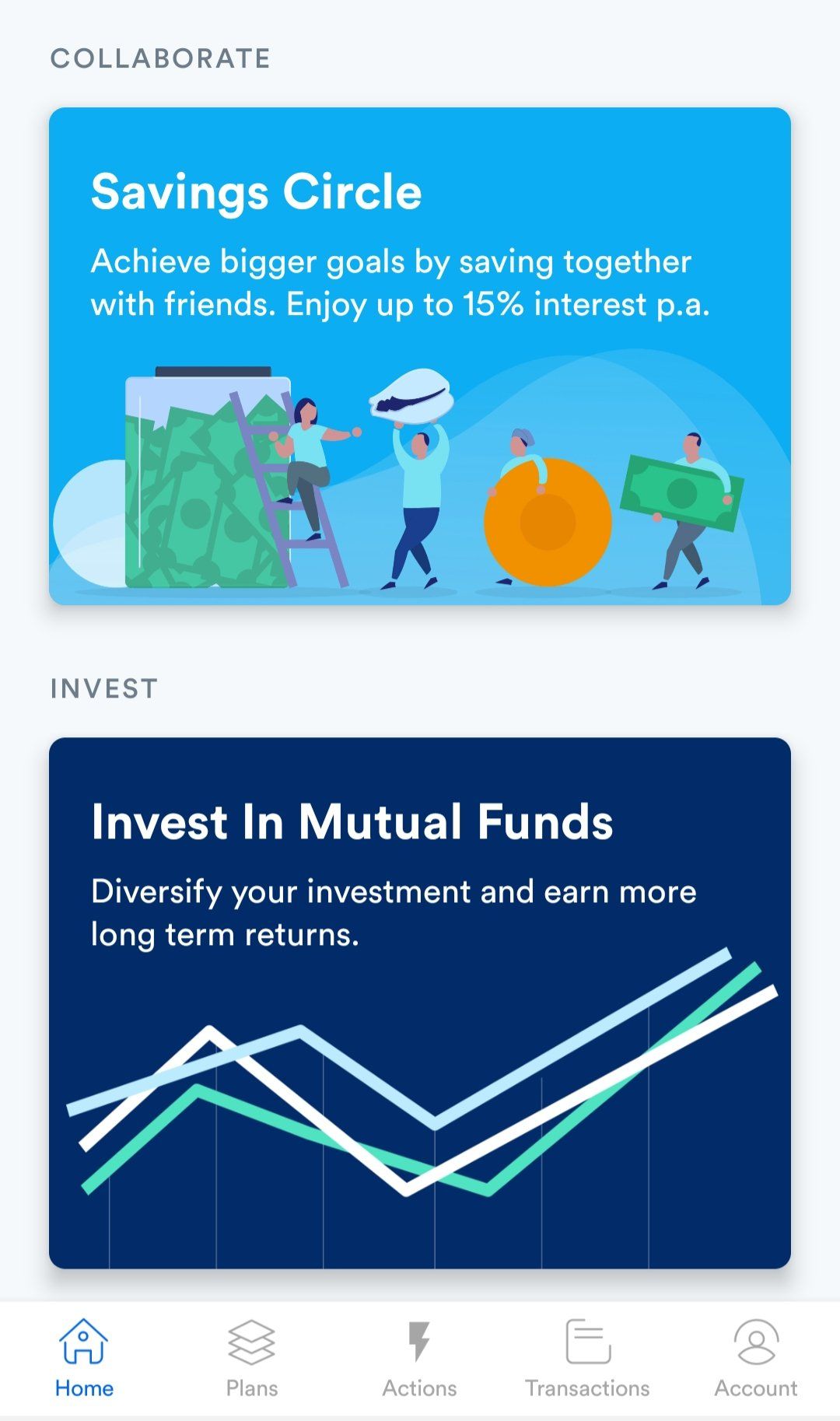

What Plans Do Cowrywise Offer?

Cowrywise offers several savings and investments plans. Each plan is structured to fit your demands. There are six saving plans on Cowrywise.

Life Goals Plan: This plan involves you saving toward important long-term goals. The minimum saving period is 1 year and you get an interest rate of 10-15% per annum.

Periodic Plan: On Cowrywise’s periodic plan, you get to save towards your short term goals as the minimum duration is 3 months with a 10-15% interest per annum.

Save As You Earn Plan: A simple plan which lets you save whenever you earn. Unlike other plans, it is not automated, you save manually depending on when you have.

Savings Circle Plan: Like its name already denotes, this plan is a group saving plan. Meaning you can save up with your family and friends. This plan has two packages- The collections scheme which is a group saving plan where only one person (the creator) has access to withdraw funds. This to me is quite similar to the local “Esusu” contribution our parents do/did. But to me, it is a more reliable way. While the second package called “the challenges” is a group saving where all members save towards a goal and at the end of the challenge, funds are returned to individual accounts. Interest rates stand at 10-15% per annum.

Halal Savings Plan: This plan is ideal for Muslim faithful and others who do not want to accrue interests on their Savings.

Fixed Investment Plan: This plan involves you saving larger sums of money for terms ranging from 3 months to 1 year, 5 years or more. The higher the amount saved and the farther the withdrawal date, the better your interest rates.

Plan, Save, Invest

Planning towards goals, saving towards future plans, unforeseen circumstances and starting investment plans, Cowrywise offers all these. You can plan and save towards life goals such as vacation, retirement, Buying a home or renting one, business capitals, emergency funds e.t.c. Recently, Cowrywise also introduced investment plans. So you can Plan, save and invest under one platform. The journey to securing the bag as a smart money woman almost can’t get any better than this.

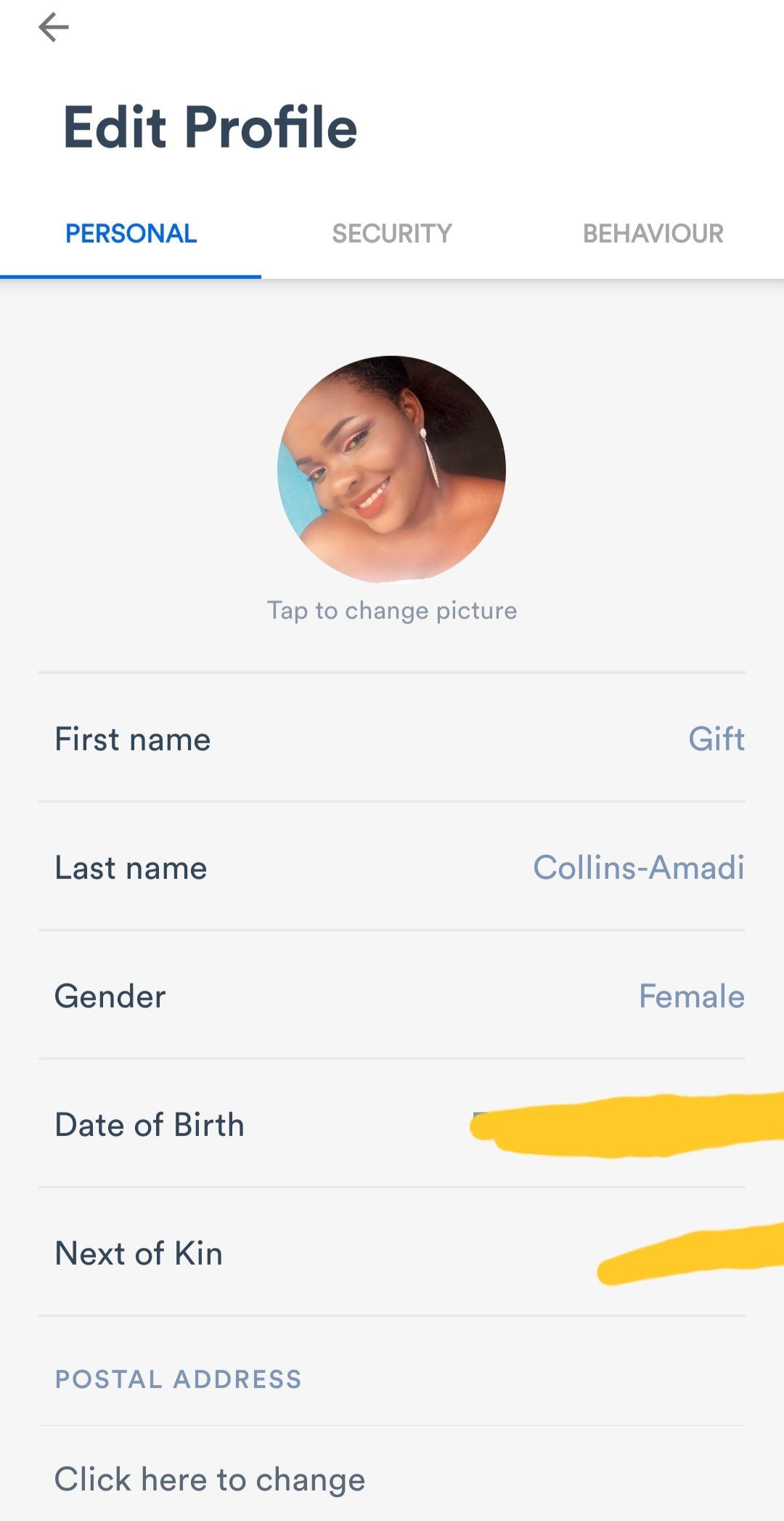

My Experience Using Cowrywise To Secure My Financial Life

I first downloaded the Cowrywise app via Google play store and signed up in January 2019, I signed up, found the interface to be too daunting and this discouraged me.

During this time, their amazing customer care, refused to give up on my case and constantly checked and reminded me to save using Cowrywise.

I got a few emails from a customer service representative who always signed off her emails as “your favourite advisor” a term which if I am being totally honest, made me feel special.

A few months ago, I got back to using Cowrywise, this time around, their interface had been updated to a user-friendly version. It was more attractive, easier to understand and very self-explanatory. It took me no time to start and save with a plan and this was smoothly done.

I especially love the variety of plans available on Cowrywise and the amazing part is one can start several plans which mean you can save towards various reasons/goals all at the same time if you so wish. This is simply awesome!

Also, I was pleased when I saw they had a retirement saving plan, I mean how amazing is that! I recently started out in the corporate world and I was intrigued that asides the retirement benefits that come with one’s job, you can personally save towards your retirement via Cowrywise. Talk about securing the bag and invariably your financial future and freedom.

You might be wondering why the need to start saving towards retirement when I’ve only just started out, I know, because I thought so too until I realized that those dreams of lounging and enjoying old age in the pure bliss that comes with financial freedom requires me planning towards that from NOW.

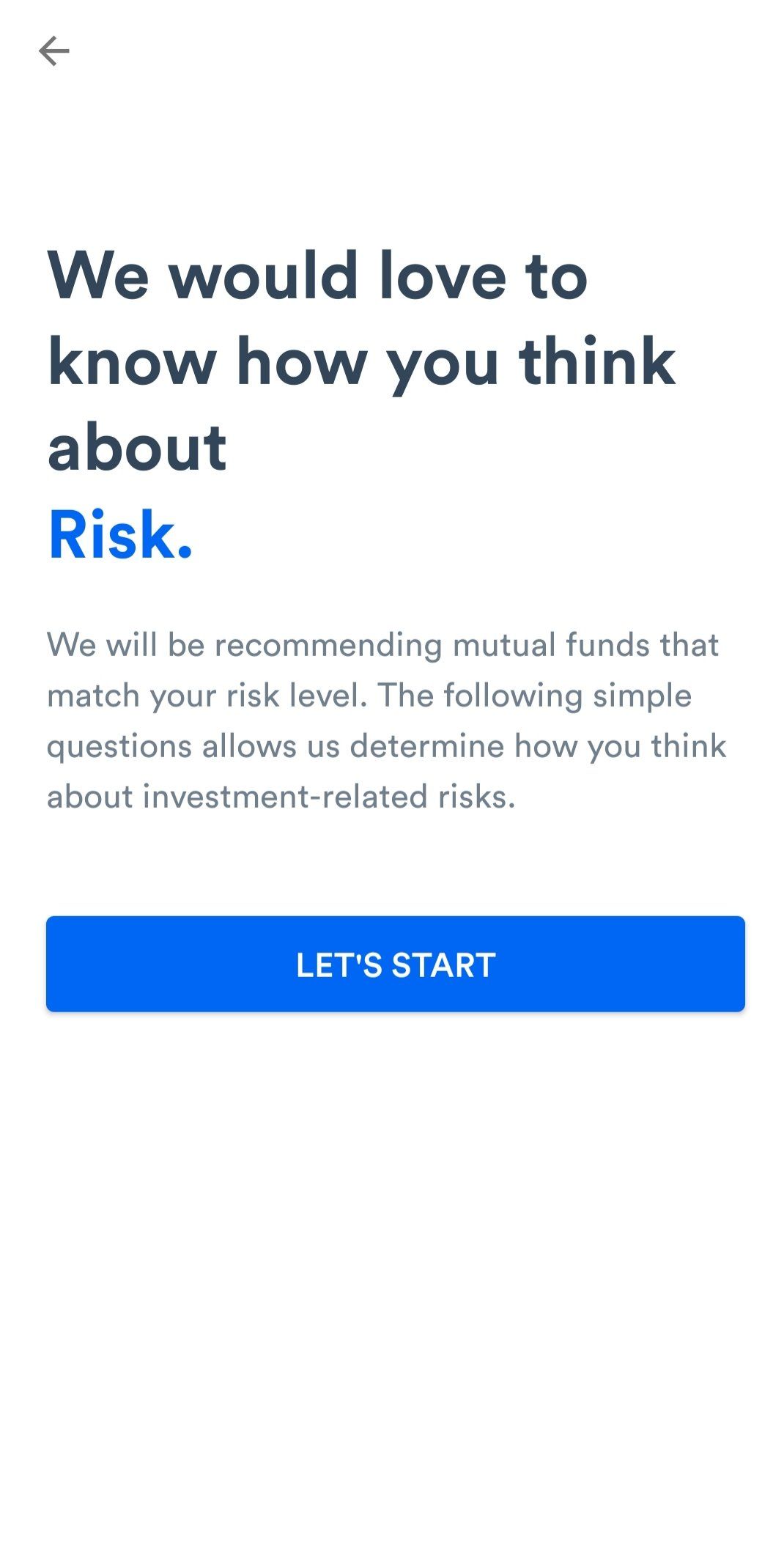

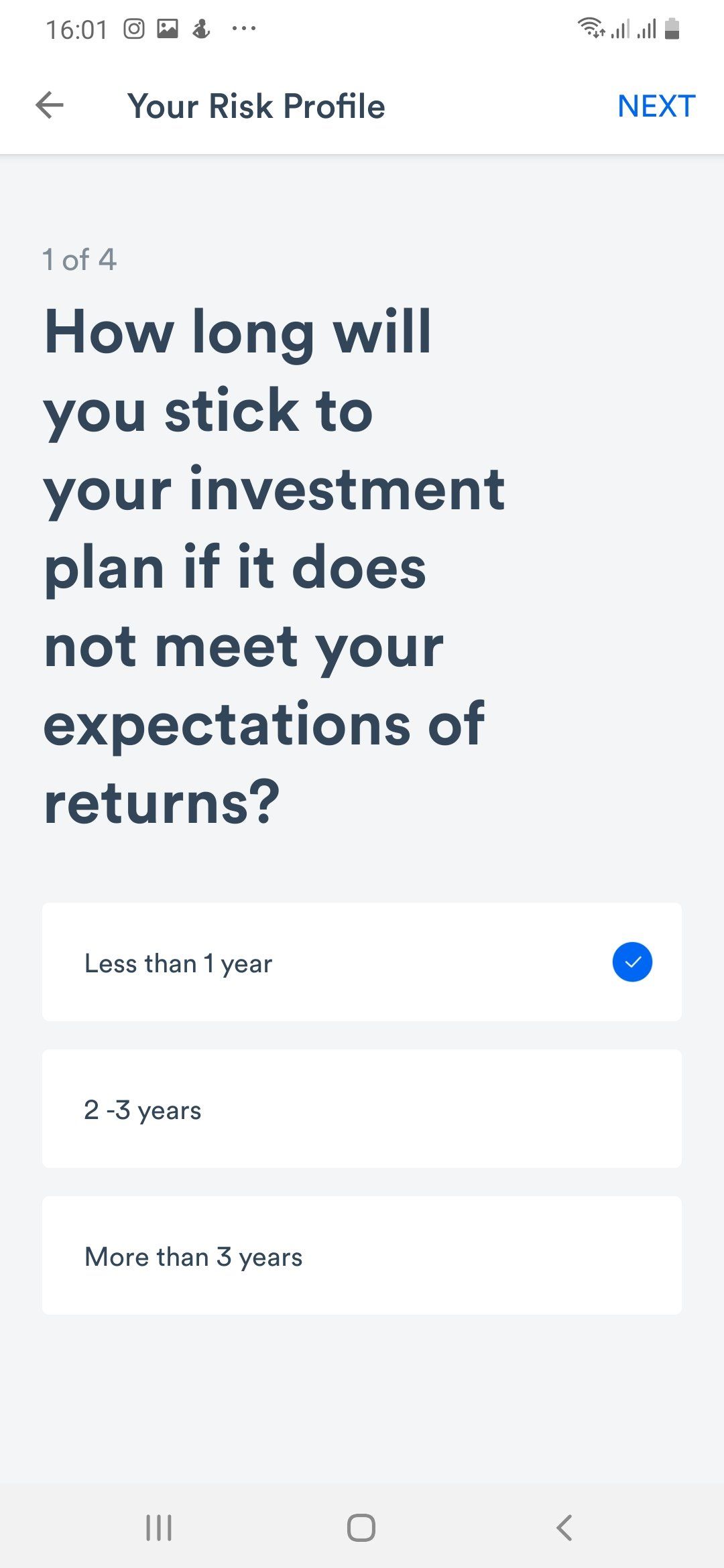

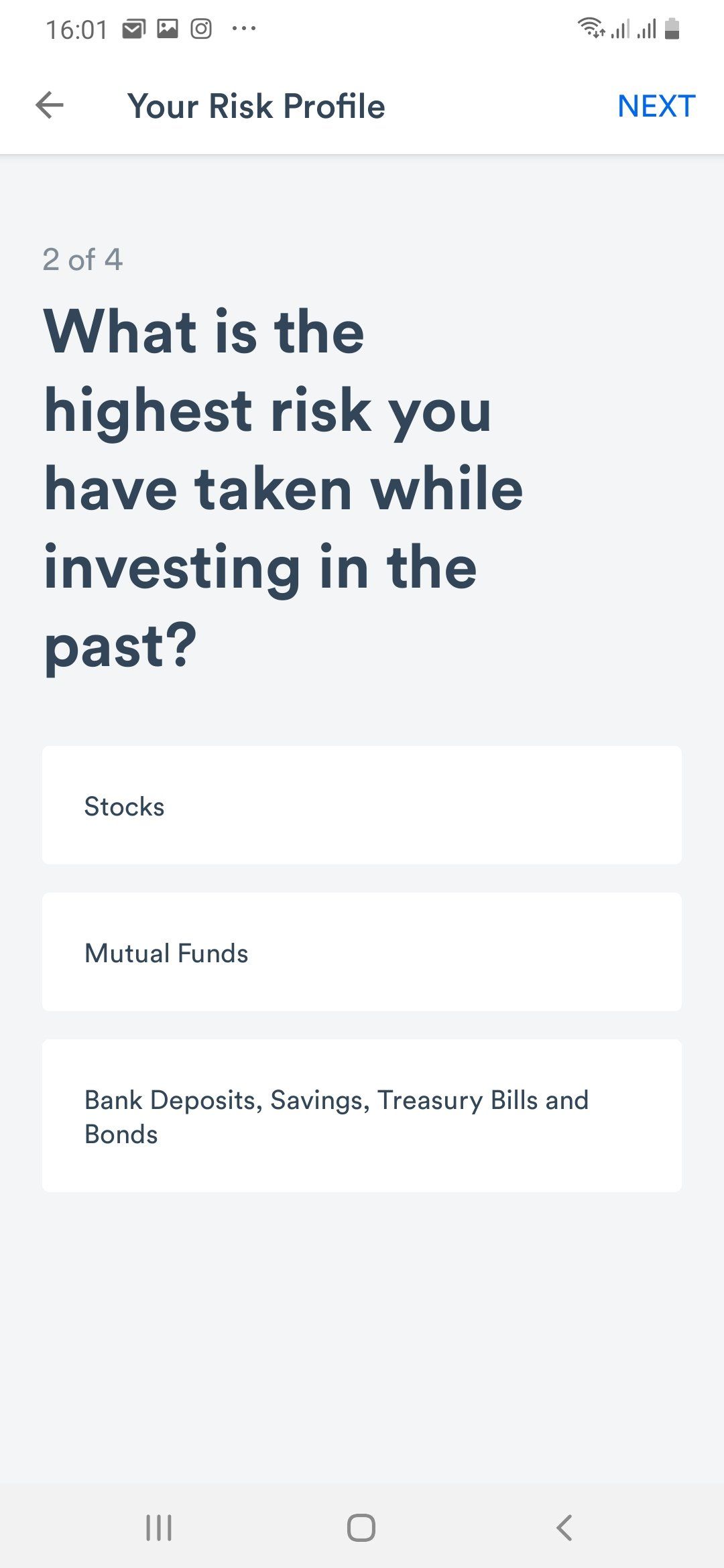

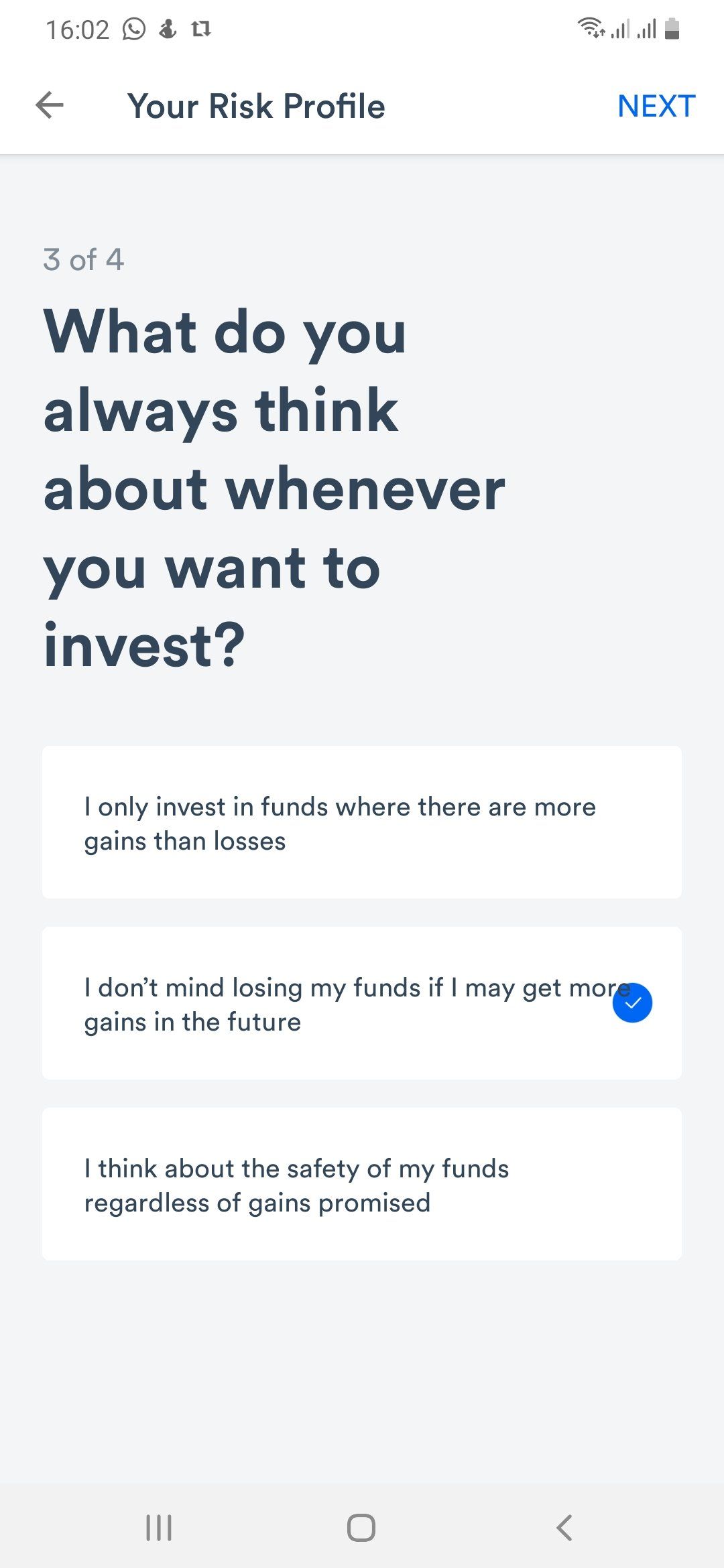

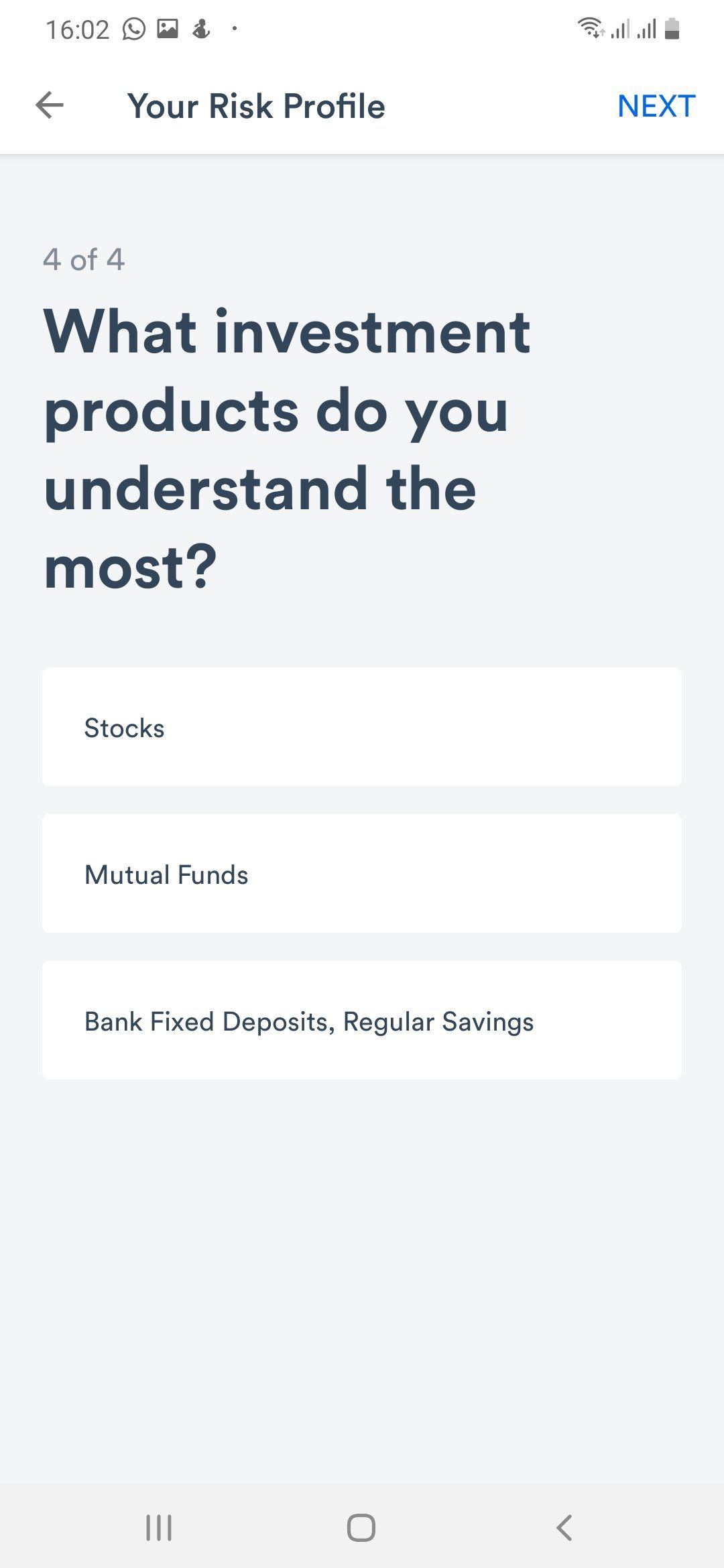

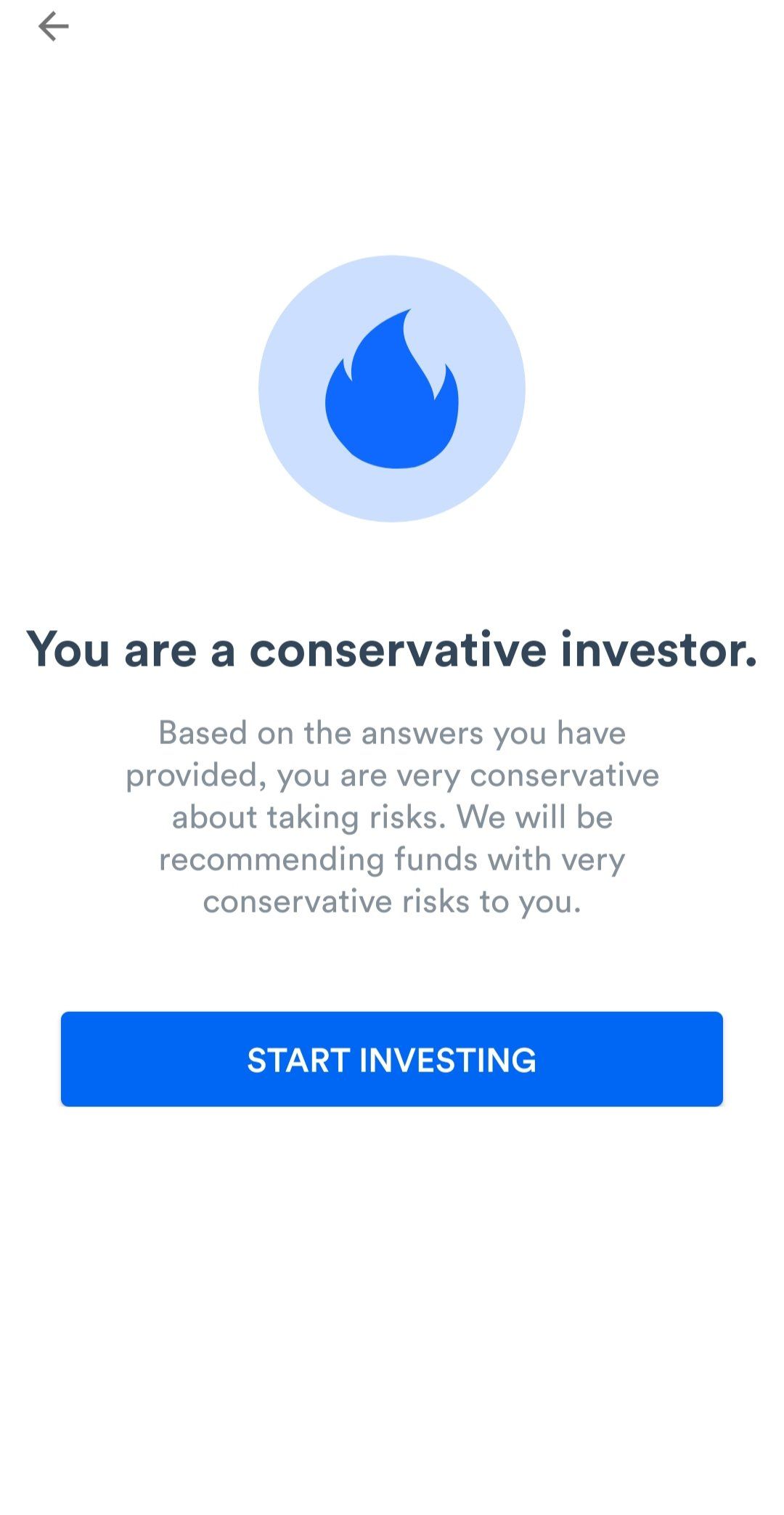

I am yet to start investing via Cowrywise because I know next to nothing about investments but some of my fears have been allayed after I ascertained my risk profile through the quiz Cowrywise provided.

Having determined my risk level, I am better equipped to try my hands on using Cowrywise to invest and savemore. Once I do, I will definitely be updating you all.

The BIG Question- is Money SAFE on Cowrywise?

The answer to this big question is a big YES. Your savings and investments are secured. Cowrywise is a registered company with a physical office in Ikeja, Lagos, Nigeria. Funds are secured via a partnership with Meristem Trustees, a public trust firm regulated by the Security and Exchange Commission (SEC). Also, sensitive details such as bank/atm details are encrypted according to global standards. You can read more about how secure Cowrywise is here. Personally, I have saved with them and experience no money troubles, whatsoever.

Everyone Can Save On Cowrywise, Including You!

I am securing my financial life with Cowrywise and so can you too. Saving and Investing on Cowrywise is open to everyone who has access to a mobile device or Laptop and functional Nigerian bank cards.

All you need do is download the app or go to www.cowrywise.com on your PC, and proceed to register, choose one of the saving or investment plans and start saving. You can save from as low as N100 and choose to save daily, monthly or at any time you have money.

Amazingly, you also earn while using Cowrywise to save and invest as they give you a referral bonus of N250 on each person that signs up to Cowrywise using your unique referral link. Imagine if you get 50 people to sign up via your referral link, that’s a whooping N12,500. To get started, sign up using my Cowrywise link to get N250 free.

As I continue to “secure the bag” using Cowrywise to save and invest, I will share more about my journey with you all. But for now, let’s discuss.

Are you a Cowrywise user or are you just hearing about Cowrywise for the first time via this post? If you have any questions as regards Saving and Investing with Cowrywise, please feel free to drop them in the comment section and I will do my best to proffer answers.

Pin me, pretty.

This post is in collaboration with The Bloggers Advocate and Cowrywise, However, all words and opinion are solely mine, given based on my experience and without bias.

I’m not a cowrywise user but I will soon, thanks for clearing my doubts.

Well detailed, thanks for sharing.